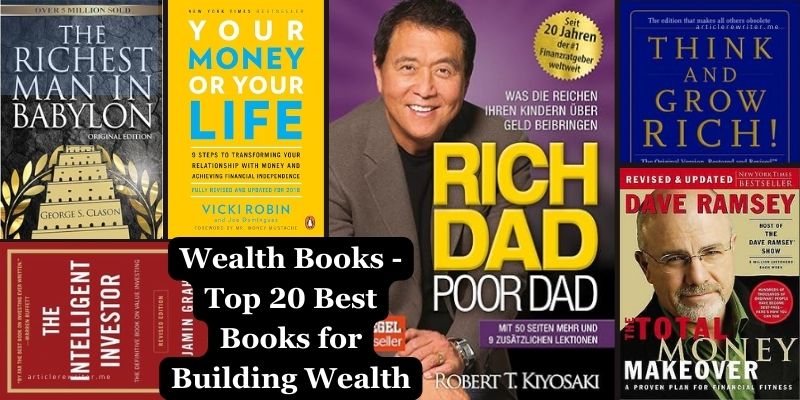

Are you a reader looking for wealth books? And how do you plan to build wealth? Building wealth requires knowledge, discipline, and a strategic mindset. Fortunately, there is a wealth of wisdom available in the form of books that can guide you on this path to financial success. In this article, I covered the top 20 best books for building wealth.

Wealth Books – Top 20 Books About Building Wealth

| Nr. | Book Name | Author | Published |

|---|---|---|---|

| 1 | Rich Dad Poor Dad | Robert Kiyosaki | 1997 |

| 2 | The Millionaire Next Door | Thomas J. Stanley and William D. Danko | 1996 |

| 3 | Your Money or Your Life | Vicki Robin and Joe Dominguez | 1992 |

| 4 | The Total Money Makeover | Dave Ramsey | 2003 |

| 5 | The Intelligent Investor | Benjamin Graham | 1949 |

| 6 | The Richest Man in Babylon | George S. Clason | 1926 |

| 7 | Think and Grow Rich | Napoleon Hill | 1937 |

| 8 | The Wealthy Barber | David Chilton | 1989 |

| 9 | Common Sense on Mutual Funds | John C. Bogle | 1999 |

| 10 | The Little Book That Still Beats the Market | Joel Greenblatt | 2005 |

| 11 | The Four Pillars of Investing | William J. Bernstein | 2002 |

| 12 | The Automatic Millionaire | David Bach | 2004 |

| 13 | The Essays of Warren Buffett | Warren Buffett and Lawrence A. Cunningham | 1997 |

| 14 | “The Bogleheads’ Guide to Investing | Taylor Larimore, Mel Lindauer, and Michael LeBoeuf | 2006 |

| 15 | The Millionaire Fastlane | MJ DeMarco | 2011 |

| 16 | I Will Teach You to Be Rich | Ramit Sethi | 2009 |

| 17 | The Simple Path to Wealth | J.L. Collins | 2016 |

| 18 | Your Road Map to Financial Independence and a Rich, Free Life | J.L. Collins | 2018 |

| 19 | Money: Master the Game | Tony Robbins | 2014 |

| 20 | The Millionaire Mind | Thomas J. Stanley | 2000 |

1. Rich Dad Poor Dad” by Robert Kiyosaki:

Rich Dad Poor Dad” is a finance and wealth book written by Robert Kiyosaki. Through the juxtaposition of his biological father (the “Poor Dad”) and the father of his childhood best friend (the “Rich Dad”), Kiyosaki imparts fundamental lessons about money, investing, and the mindset required to build wealth.

2. The Millionaire Next Door by Thomas J. Stanley and William D. Danko:

Stanley and Danko’s research-based book challenges conventional notions of wealth. They reveal that many millionaires live modest lifestyles and accumulate wealth through frugality, strategic saving, and smart investing. This book emphasizes the importance of living below your means.

3. Your Money or Your Life by Vicki Robin and Joe Dominguez:

This seminal work by Robin and Dominguez is one of the wealth books that goes beyond traditional financial advice. It encourages readers to examine the connection between their values, life energy, and money. The book offers a nine-step program to transform your relationship with money and achieve financial independence.

4. The Total Money Makeover by Dave Ramsey:

The Total Money Makeover is a wealth book written by Dave Ramsey which is a practical guide to financial fitness. Ramsey lays out a step-by-step plan for getting out of debt, building an emergency fund, and investing for the future. His emphasis on disciplined budgeting and the debt snowball method has resonated with millions seeking financial freedom.

5. The Intelligent Investor by Benjamin Graham:

It is a book often regarded as the bible of value investing, The Intelligent Investor written by Benjamin Graham has influenced countless investors, including Warren Buffett. In this book, Graham provides timeless principles for investing, focusing on the importance of a rational, disciplined approach to stock market investing.

6. The Richest Man in Babylon by George S. Clason:

Set in ancient Babylon, Clason’s book imparts financial wisdom through a series of parables. The timeless lessons include the importance of saving, investing wisely, and seeking knowledge. The book distills complex financial concepts into simple, relatable stories.

Also read: The Importance of Defining Audience in Content Writing

Also read: Make Money Writing – 15 Freelancing Websites for Freelancers

Read also: 10 Top Resume Writing Service Platforms

Related: How to Improve Your Writing Skills As A Blogger

7. Think and Grow Rich by Napoleon Hill:

Napoleon Hill’s classic self-help book delves into the power of positive thinking and goal-setting. While not explicitly a financial guide, Think and Grow Rich emphasizes the importance of a success-oriented mindset and the belief that one can achieve their financial goals through determination and visualization.

8. The Wealthy Barber by David Chilton:

The Wealthy Barber is a book on wealth written by David Chilton. It imparts financial wisdom through the character of a small-town barber. The book covers key concepts like paying yourself first, living below your means, and the magic of compound interest in a highly accessible manner.

9. Common Sense on Mutual Funds by John C. Bogle:

Common Sense on Mutual Funds by John C. Bogle is a classic investment guide that offers insightful perspectives on mutual fund investing. Bogle, the founder of Vanguard Group and a pioneer in index fund investing, advocates for a common-sense approach to building wealth through long-term, low-cost investment strategies. The book emphasizes the importance of low fees, broad diversification, and a patient, disciplined investment approach. Bogle critiques the mutual fund industry for its high fees and the prevalence of actively managed funds that often fail to outperform the market. He advocates for the use of index funds as a cost-effective and efficient way for investors to participate in the long-term growth of the stock market.

10. The Little Book That Still Beats the Market by Joel Greenblatt:

In this compact yet powerful book, Joel Greenblatt outlines his “magic formula” for investing success in “the Little Book That Still Beats the Market”. He combines value and quality factors to identify stocks with the potential for high returns. “The Little Book That Still Beats the Market” simplifies complex investing strategies for the average reader.

11. The Four Pillars of Investing by William J. Bernstein:

The Four Pillars of Investing is an investment and wealth book written by William J. Bernstein. The book explores the key principles and strategies for successful long-term investing. Bernstein introduces the metaphor of four pillars, representing the essential elements of a solid investment foundation. These pillars include the theory of investing, the history of investing, the psychology of investing, and the business of investing.

12. The Automatic Millionaire by David Bach:

The Automatic Millionaire advocates for the power of automating your finances. The book introduces the concept of “paying yourself first” by automatically saving and investing a portion of your income. It emphasizes the impact of consistent, automatic contributions over time.

Also read: Top 10 Styles of Writing

Also read: 25 Types of Writers

Read also: Difference Between Freelance Writer and Ghostwriter

Related: How to Become a GhostWriter – Beginners Guide

13. The Essays of Warren Buffett: Lessons for Corporate America:

The Essays of Warren Buffett: Lessons for Corporate America is a compilation of Warren Buffett’s letters to Berkshire Hathaway shareholders, spanning several decades. It was compiled and edited by Lawrence A. Cunningham. The book serves as a comprehensive guide to Buffett’s investment philosophy and his thoughts on corporate governance. The essays cover a wide range of topics, including business valuation, economic principles, corporate governance, and the role of a CEO.

14. The Bogleheads’ Guide to Investing:

The Bogleheads’ Guide to Investing” by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf is a comprehensive and accessible guide to long-term, low-cost investing based on the principles of John C. Bogle, the founder of Vanguard Group. The book is a part of the Bogleheads’ investment philosophy, which emphasizes simplicity, low fees, and a passive, index fund approach.

15. The Millionaire Fastlane by MJ DeMarco:

The Millionaire Fastlane by MJ DeMarco challenges the traditional path to wealth that involves decades of saving and investing. Instead, he advocates for creating wealth quickly through entrepreneurship and innovative thinking. DeMarco provides a blueprint for building a business that can accelerate the journey to financial freedom.

16. I Will Teach You to Be Rich by Ramit Sethi:

Ramit Sethi’s approach to personal finance is both practical and humorous. In “I Will Teach You to Be Rich,” he offers actionable advice on automating finances, optimizing credit cards, and investing wisely. The book is geared towards young professionals but contains timeless principles for anyone looking to build wealth.

Also read: Is Paid Online Writing Jobs Legitimate

Read also: 15 Creative Writing Techniques

Related: 13 Strategies for Becoming an Effective Writer

17. The Simple Path to Wealth by J.L. Collins:

J.L. Collins distills his investment philosophy into “The Simple Path to Wealth.” He advocates for a straightforward approach to investing, focusing on low-cost index funds and the importance of saving. Collins combines personal anecdotes with practical advice to make complex financial concepts accessible to all.

18. Your Road Map to Financial Independence and a Rich, Free Life:

In this finance and wealth book, J.L. Collins delves into the path to financial independence. “Your Road Map to Financial Independence and a Rich, Free Life” expands on the concepts presented in his first book, offering a comprehensive guide to achieving financial freedom and living a fulfilling life.

19. Money: Master the Game by Tony Robbins:

Money: Master the Game is a book by Tony Robbins Published in 2014, and offers a comprehensive guide to achieving financial success and independence. Robbins explores the strategies and insights of some of the world’s most successful investors and financial experts. The book covers a wide range of topics, including investment principles, asset allocation, and retirement planning.

20. The Millionaire Mind” by Thomas J. Stanley:

The Millionaire Mind by Thomas J. Stanley is a follow-up to Stanley’s earlier work, “The Millionaire Next Door.” In this book, Stanley continues his exploration of the habits, attitudes, and characteristics of millionaires, focusing particularly on their mindset and the factors that contribute to their financial success. Stanley conducted extensive surveys and interviews with millionaires to uncover common traits and patterns in their behavior. The book challenges common stereotypes about wealth, highlighting that many millionaires are self-made individuals who have accumulated wealth through disciplined saving, investing, and entrepreneurial endeavors.

Also read: 25 Benefits of Article Rewriting Tools

Read also: 15 Mistakes to Avoid When Writing College Research Paper